Mengyang (Billy) Guo, CPA, CFA

I'm a 5th-year PhD candidate in Accounting at the University of British Columbia.

My research examines corporate disclosure, with papers under revision at JAE and TAR.

I'm currently on the 2025–26 job market for tenure-track assistant professor positions.

© 2025 Mengyang Guo. All rights reserved.

Research

Managers are storytellers: the way they frame accounting numbers influences how markets and competitors react. This human dimension of disclosure lies at the heart of my research.

I have two disclosure papers in the editorial process:

[1] “How Competition Influences Firm-Specific vs. Industry-Wide Narratives in Earnings Conference Calls”, solo-authored, under revision for the 2nd-round review at The Accounting Review. [Read More]

(based on my job market paper)

[2] “Formal and Informal Language in Earnings Conference Calls”, with Kin Lo, under revision for the 3rd-round review at Journal of Accounting and Economics. [Read More] [SSRN]

(based on my third-year paper)

Here are some additional papers currently in preparation for submission or in progress:

[3] “Strategic Pessimism: The Economic Benefits of Deterrent Disclosures”, solo-authored, manuscript in preparation for journal submission.

[4] “Geopolitical Risk and Non-Deal Roadshows: Private Communication During Uncertain Times”, with Emily Jing Wang and Jenny Li Zhang, work in progress.

[5] “The Social Ties between Auditors and Client Executives: Novel Evidence from U.S. Golfing Records”, with Xin Zheng, work in progress.

Through my pipeline projects, I apply new methods and data to uncover how managers shape disclosure for investors, competitors, and other audiences. I aim to advance the frontier of research on corporate communication.

© 2025 Mengyang Guo. All rights reserved.

Teaching

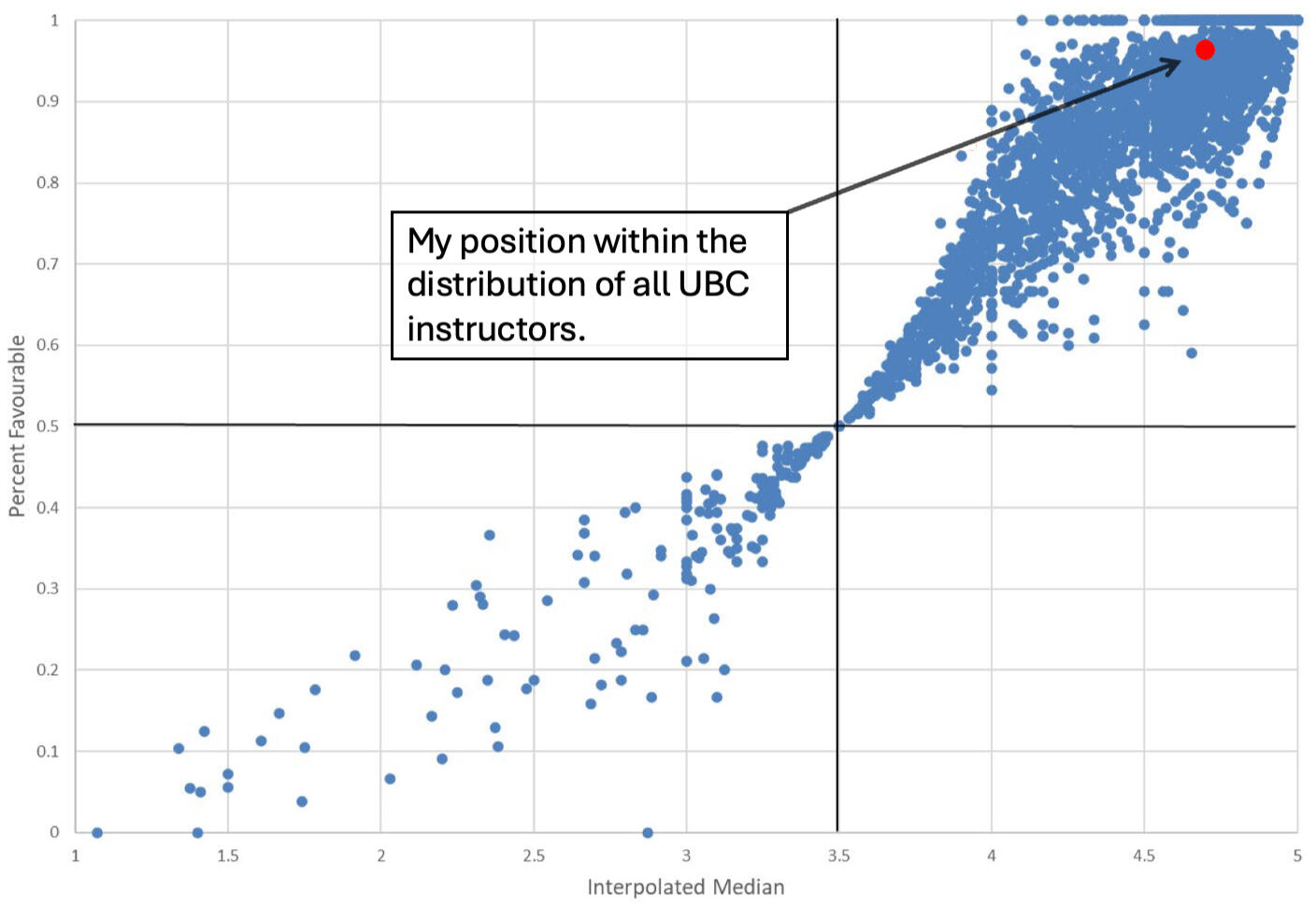

At UBC, I taught undergraduate Managerial Accounting as the instructor and earned a teaching evaluation of 4.7/5.0 and a 96% favorable rating [Evaluation Report & Relative Performance].

I was honored to receive the Killam Graduate Teaching Award for teaching excellence, becoming a Killam Laureate.

My CPA license (US) enables me to teach a broad range of accounting courses, including financial accounting, auditing, and US taxation.

To make accounting concepts clear and engaging, I incorporate activities, examples, and games. My students have responded with comments such as:

"Good job keeping us entertained with humor and getting us to interact with the questions. I felt engaged during class as a result."

"The way Billy taught the course made it a lot easier for me. [...] Billy made it simple and easy to understand."

"Don’t change. You are the best prof I’ve ever had. I loved having you."

© 2025 Mengyang Guo. All rights reserved.

About

I'm currently a PhD candidate in Accounting and expect to graduate in 2026. See my PhD story featured by UBC — click below:

Before beginning my PhD, I earned a Master of Science in Accounting from Boston College and a Bachelor of Economics from Sichuan University.

I hold an active CPA license in Massachusetts [eLicense Here]. I'm also an active CFA charterholder [CFA Charter Badge].

I was born and raised in Beijing, China, and now live in Vancouver, Canada. I enjoy alpine scrambling in the coastal mountains near Vancouver. I have a four-legged friend, Miao Miao.

© 2025 Mengyang Guo. All rights reserved.

How Competition Influences Firm-Specific vs. Industry-Wide Narratives in Earnings Calls

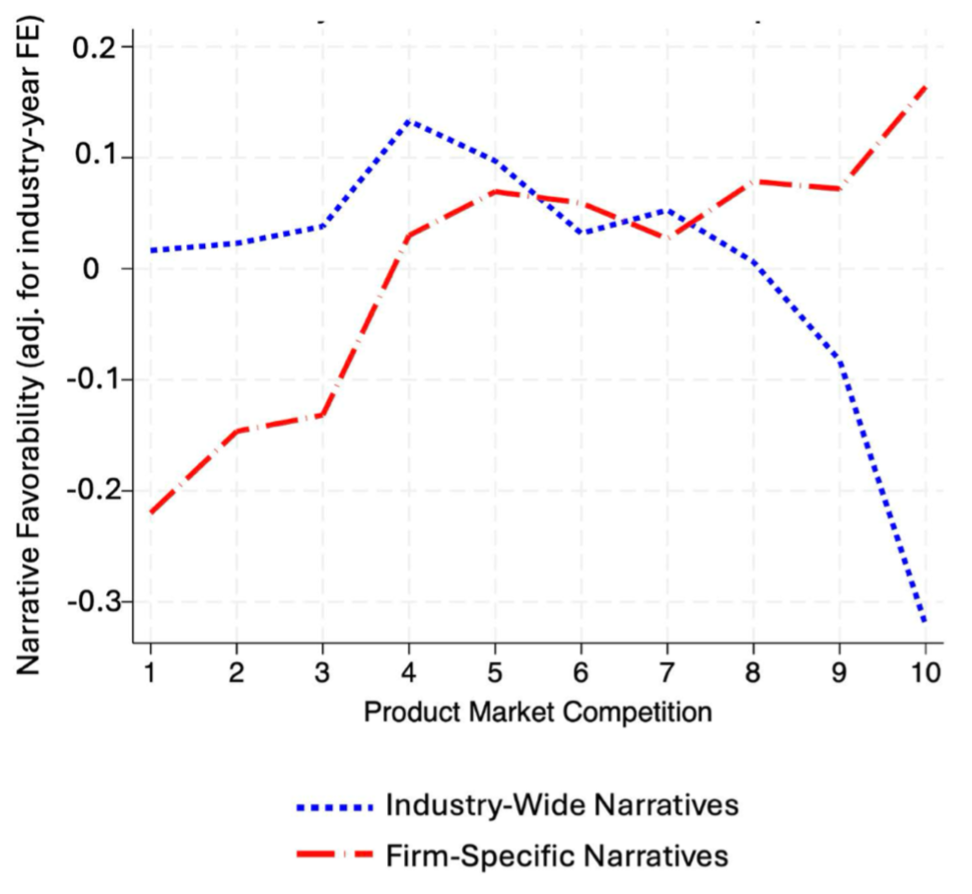

Prior research gives mixed results on whether competitive threats from potential entrants lead firms to strategically disclose more good news or more bad news. One reason is that disclosures contain both firm-specific and industry-wide information.

I use large language models to separate these two dimensions in earnings calls. Consistent with prior theory, I find that when facing entry threats, firms emphasize their own strengths (to signal high costs of confrontation) while stressing industry-wide challenges (to suggest a bleak future for potential entrants).

As product market competition increases, firms emphasize more favorable firm-specific narratives while portraying industry-wide narratives more negatively.

This helps explain why earlier studies reached conflicting conclusions and underscores the importance of distinguishing between firm-specific and industry-wide information when examining the effects of competition.

© 2025 Mengyang Guo. All rights reserved.

Formal and Informal Language in Earnings Calls

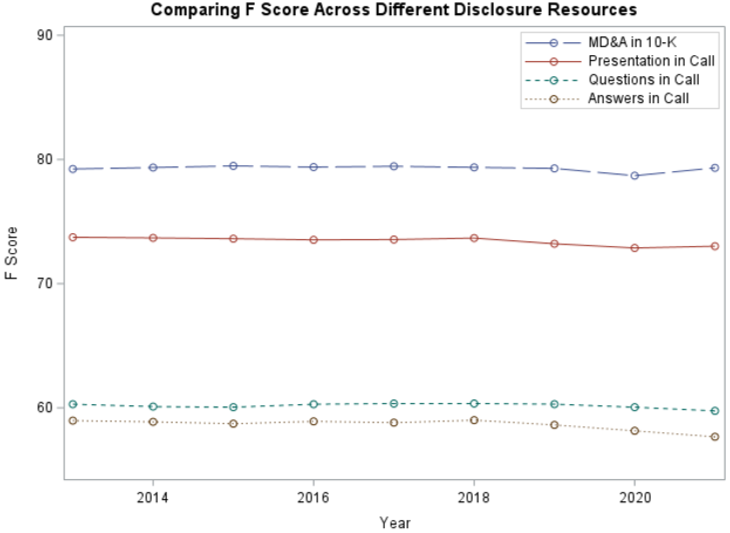

Formality is a concept central to sociolinguistics. In this project, we study how the style of language—formal vs. informal—affects how investors react to earnings calls. We use computational linguistics tools to measure the language formality of firm disclosure.

We compare formality across disclosure resources, finding that MD&A sections in 10-K filings are the most formal, management presentations are somewhat less formal, and Q&A sections are the least formal.

We find that when managers use informal language, investors and analysts disagree more and respond negatively. Over time, firms that rely on informal language tend to underperform and report negative earnings surprises. This suggests that managers may use a conversational tone not to clarify information, but to soften or hide bad news.

We introduce a novel measure of language style and demonstrate its importance for understanding how managers shape investor perceptions.

© 2025 Mengyang Guo. All rights reserved.

Student Evaluation at UBC (2024 Winter - Managerial Accounting)

My evaluation score within the distribution of all UBC instructors:

NOTE: This figure plots my relative position within the distribution of all UBC instructors based on data from the Student Experience of Instruction 2022W Report to Senate (the most recent report available, to my knowledge, as of 2025). The chart summarizes responses to Question #6: “Overall, I learned a great deal from this instructor.” The horizontal axis shows the Interpolated Median score (on a 1–5 scale), and the vertical axis represents the Percent Favourable Rating—the percentage of students who selected 4 (“Agree”) or 5 (“Strongly Agree”). The red dot marks my own score.

My student evaluation report:

© 2025 Mengyang Guo. All rights reserved.

Miao Miao is my golden British Shorthair (born April 2024 in Richmond, BC). She’s very chatty — meowing is her favorite way to communicate.

She's smart, and even knows how to turn the lights on and off! Although she’s a girl, she’s been neutered, and she brings endless energy to my home every day.

© 2025 Mengyang Guo. All rights reserved.

Contact

I always enjoy connecting with new people! Whether you’d like to chat about research, teaching, or possible collaborations, I’d be happy to hear from you.Please drop me a note using the form below or email me at [email protected]

© 2025 Mengyang Guo. All rights reserved.

Thank you

Thanks so much for your message—I really enjoy hearing from new people! I’ll be in touch soon.

© 2025 Mengyang Guo. All rights reserved.